Launched by the National Stock Exchange (NSE) in 1996, the Nifty Next 50 index is a subgroup of the Nifty 100, featuring companies ranked 51st to 100th on the NSE. Also known as the ‘Junior Nifty’, the index spotlights emerging firms in sectors like finance and IT.

Representing almost 18% of NSE’s market cap, Nifty Next 50 undergoes biannual rebalancing to mirror market dynamics. Despite facing challenges in recent years, the Nifty Next 50 index continues to offer promising opportunities for investors. While it may have lagged behind Nifty and Sensex in the last few years, its potential for growth remains strong.

Junior Nifty has been in the spotlight recently for its entry into the derivatives market. The NSE has launched derivative contracts on the Nifty Next 50 index, which came into effect on April 24, 2024, post approval from the Securities and Exchange Board of India (SEBI). Let’s explore the index’s functionality, features, and distinctions from the Nifty 50.

What is Nifty Next 50?

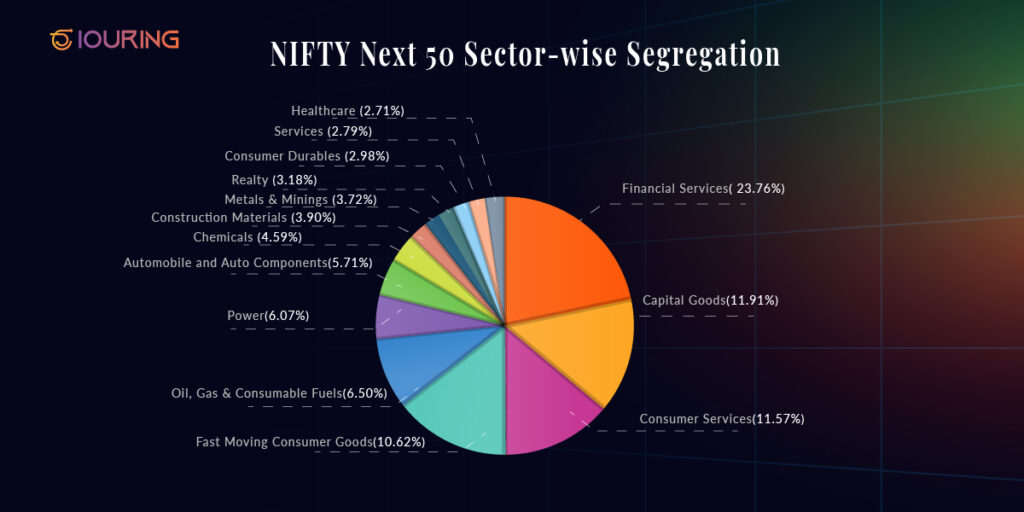

The Nifty Next 50, a comprehensive index on the National Stock Exchange (NSE), tracks the performance of 50 companies selected from the Nifty 100 index after excluding the top Nifty 50 constituents. These companies operate across 14 sectors, with Financial Services, FMCG, Metals & Mining, and Consumer Services comprising close to 50% of the index. Additionally, exposure to sectors like Oil, Gas & Consumable Fuels, Power, Capital Goods, Automobile and Auto Components, Consumer Durables, Chemicals, Realty, Construction Materials, Services, and Healthcare is available through the Nifty Next 50.

Capturing nearly 12% of the float-adjusted market capitalization on the NSE, the Nifty Next 50 index represents a significant portion of the exchange. The combined traded value of all index constituents accounts for around 13% of the total traded value of all stocks on the NSE over the past six months.

As of March 2024, the financial services sector holds a prominent position in the Junior Nifty. With a market capitalization of Rs 70 trillion, it accounts for 18% of the total market capitalization on the NSE.

Launched on December 24, 1996, with a base year of 1996, a base value of 1000, and a base capital of 0.43 trillion rupees, the Nifty Next 50 index undergoes biannual reconstitution. In the last 52 weeks, the index has ranged between 38,000 and 63,000 in price.

Governed by a three-tier structure comprising the BOD of NSE Indices Limited, the Index Advisory Committee (Equity), and the Index Maintenance Sub-Committee, the Nifty Next 50 index also includes a variant known as the Nifty Next 50 Total Returns Index. This index serves as an ideal benchmark for evaluating fund portfolios, index funds, ETFs, and structured products.

Nifty Next 50 Sector-wise Segregation

| Sector | Weight |

| Financial Services | 23.76% |

| Capital Goods | 11.91% |

| Consumer Services | 11.57% |

| Fast Moving Consumer Goods | 10.62% |

| Oil, Gas & Consumable Fuels | 6.50% |

| Power | 6.07% |

| Automobile and Auto Components | 5.71% |

| Chemicals | 4.59% |

| Construction Materials | 3.90% |

| Metals & Minings | 3.72% |

| Realty | 3.18% |

| Consumer Durables | 2.98% |

| Services | 2.79% |

| Healthcare | 2.71% |

What are Nifty Next 50 Companies?

As of April 18, 2024, the Nifty Next 50 has the following constituents:

| JIOFIN | INDIGO | SRF | VBL | ZYDUSLIFE |

| ICICIGI | SIEMENS | PFC | CHOLAFIN | ADANIENSOL |

| VEDL | BAJAJHLDNG | CANBK | GAIL | LICI |

| TRENT | IOC | DABUR | BOSCHLTD | ADANIGREEN |

| BANKBARODA | TATAPOWER | MCDOWELL-N | GODREJCP | TVSMOTOR |

| MOTHERSON | SBICARD | MARICO | ICICIPRULI | IRCTC |

| TORNTPHARM | PIDILITIND | NAUKRI | COLPAL | DLF |

| HAVELLS | RECLTD | DMART | HAL | SHREECEM |

| PNB | AMBUJACEM | BEL | ATGL | BERGEPAINT |

| JINDALSTEL | IRFC | ADANIPOWER | ZOMATO | ABB |

How is Nifty Next 50 Calculated and How Are Stocks Selected for Inclusion in Nifty Next 50?

The computation of the Nifty Next 50 index adheres to a meticulous methodology aimed at precision and representativeness. Initially, a base period is established, serving as the index’s reference point, often denoted by a specific date like January 1, 2000, with a base value of 1000.

Utilizing a free-float market capitalization methodology, the index determines the weightage of each stock based on its market capitalization, considering only tradable shares in the market. This approach guarantees an accurate reflection of the constituent stocks’ overall market value.

The calculation process entails several steps:

- Determining the market capitalization of each company in the Nifty Next 50 index by multiplying the stock’s current market price by the tradable shares.

- Applying the free-float factor to adjust for shares not available for trading, such as those held by promoters or government entities, based on the tradable percentage.

- Calculating the adjusted market capitalization of each stock by dividing it by the sum of all adjusted market capitalizations in the index.

- Computing the weightage of each stock in the Nifty Next 50 index.

- Deriving the index value by multiplying the base value (established during the base period) by the cumulative product of the stock weightages, ensuring accurate reflection of any changes in constituent stocks’ market value.

The index value is calculated as –

Index value = Current free float market capitalization/ (Base free float market capitalization * Base Index Value)

For a company to qualify for inclusion in the Nifty 50 index, it must satisfy criteria including market capitalization, liquidity, and financial performance.

Types of Nifty Next 50 Index Funds

Direct Index Funds: These funds mirror the Nifty Next 50 index by investing in the same constituents with identical proportions, providing a straightforward and cost-efficient means to access Nifty Next 50 stocks.

ETFs (Exchange-Traded Funds): Nifty Next 50 ETFs are traded on stock exchanges similar to individual stocks, offering the flexibility of buying and selling at market prices during trading hours. ETFs are well-known for their low expense ratios and tax efficiency.

Index Mutual Funds: Managed by professional fund managers, these investment vehicles aim to mimic the Nifty Next 50 index’s performance. They cater to investors seeking a passive investment strategy, as the fund manager oversees portfolio composition and rebalancing.

Sector-based Index Funds: Certain funds track particular sectors or industries within the Nifty Next 50 index, like banking, technology, or healthcare. These funds enable investors to concentrate on specific sectors they anticipate will surpass the overall market performance.

Characteristics of Nifty Next 50 Index

Generally, index funds stand by greater diversification and reduced risk while giving a broad range of ownership to stockholders. That’s why many investors, particularly newcomers, prefer investing in index funds rather than individual stocks. Let’s look at a few characteristics that make Nifty Next 50 a good investment.

- Features Top Companies: Junior Nifty index features large-cap stocks, including the 50 companies from Nifty 100 excluding Nifty 50.

- Diversified and Least Concentrated: It comprises stocks from 17 diverse sectors of India’s economy. The Nifty Next 50 has a more balanced distribution of holdings compared to Nifty 50. In Junior Nifty, the top 10 stocks account for about 34% of the index’s total value, making it the least concentrated among large-cap indices.

- Path to Nifty 50: Nifty Next 50 often serves as a feeder for Nifty 50 promotions. Companies in the Junior Nifty often get promoted to the Nifty 50 as their market capitalization increases.

- Outperforming the Benchmark Index: Over the past five years, Nifty Next 50 has outperformed with a 126.6% growth compared to Nifty 50’s 91% growth.

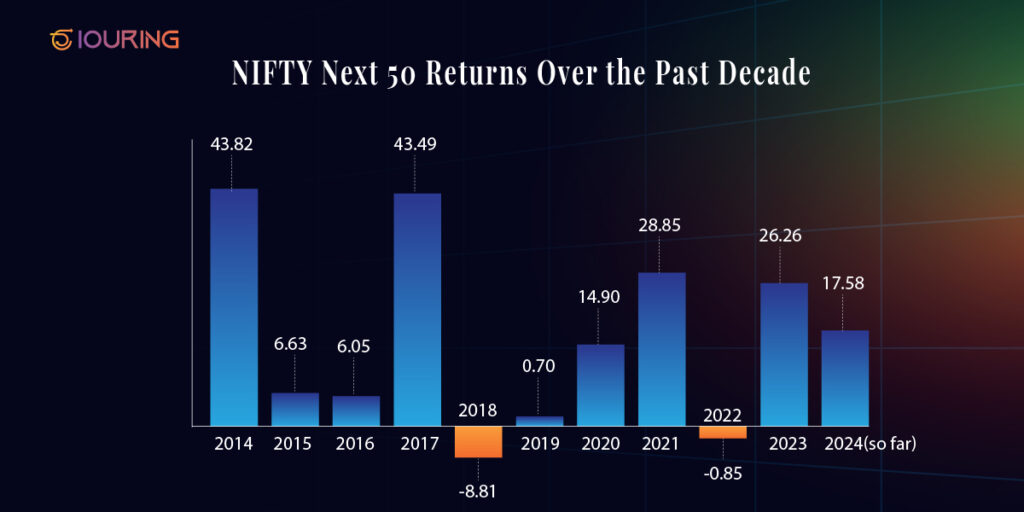

Returns Of Nifty Next 50

Nifty returns assess the index’s performance within a defined timeframe, offering insights into the profitability and growth prospects of its constituent stocks. Checkout the returns of Nifty Next 50 below.

| Year | Yearly Return (in %) |

| 2024 | 17.58 |

| 2023 | 26.26 |

| 2022 | -0.85 |

| 2021 | 28.85 |

| 2020 | 14.90 |

| 2019 | 0.70 |

| 2018 | -8.81 |

| 2017 | 43.49 |

| 2016 | 6.05 |

| 2015 | 6.63 |

| 2014 | 43.82 |

Here are essential considerations regarding Nifty returns:

- Nifty returns gauge index performance, offering insights into stock profitability and growth potential.

- Historical Nifty returns reflect past index movements, aiding in informed investment decisions.

- Nifty returns serve as benchmarks for comparing individual stock or portfolio performance against the market.

- Comprehensive Nifty returns encompass price appreciation and dividend income, presenting overall index returns.

- Nifty returns indicate risk and volatility associated with Nifty Next 50 stocks, balancing potential rewards with market fluctuations.

What is the Difference between Nifty 50 and Nifty Next 50?

Various factors such as investment goals, risk tolerance, and market conditions are taken into consideration while evaluating Nifty 50 vs Nifty Next 50.

The Nifty Next 50 index includes companies with growth potential beyond the top 50, aiming to capture emerging leaders. However, it generally involves higher risks and volatility due to the nature of these companies. The Nifty 50, on the other hand, consists of established blue-chip companies and is often considered more stable.

Investors seeking potentially higher returns and willing to tolerate greater risk might find the Nifty Next 50 appealing. Those who prioritize stability and are more risk-averse may prefer the Nifty 50. Both indices offer unique opportunities, so the choice depends on individual investment preferences.

Here is a brief comparison of both the indices’ returns over the past few years.

| Index | YTD (as of 24th April) | 6 Months | 1 Year | 5 Years | Max |

| Nifty 50 | 3.75% | 17.40% | 26.52% | 90.98% | 2420% |

| Nifty Next 50 | 18.75% | 46.07% | 64.43% | 127.15% | 2657% |

NSE Launched Derivatives on Nifty Next 50 Index

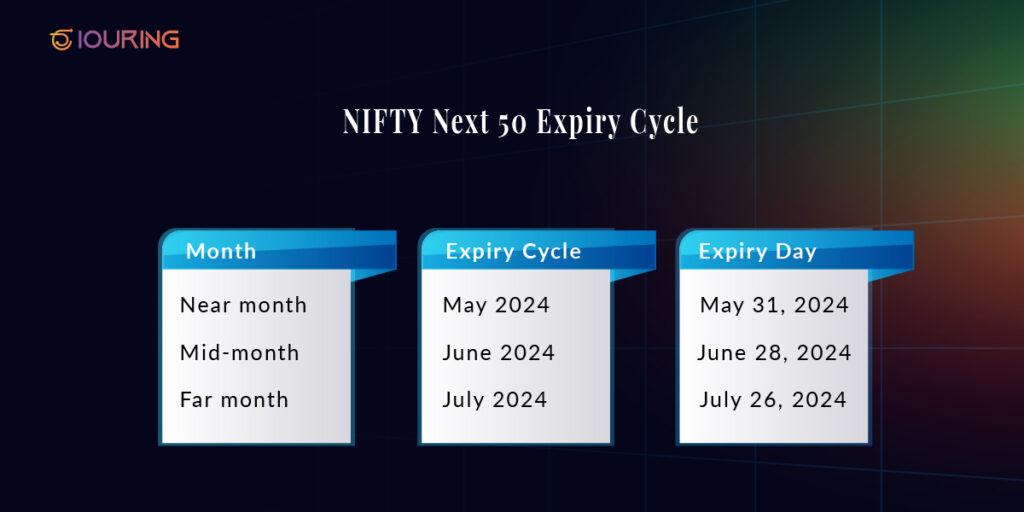

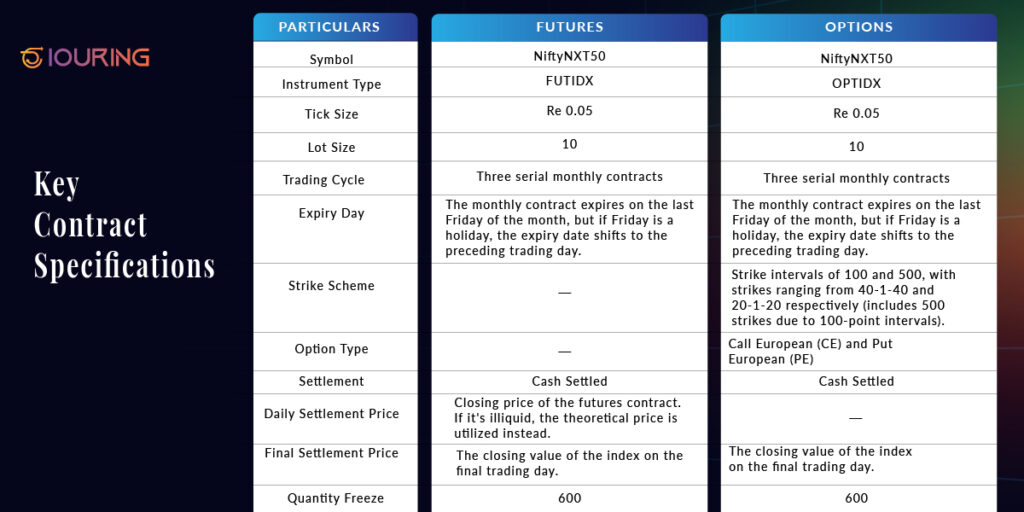

The NSE has introduced derivative contracts on the Nifty Next 50 index from April 24, expanding its product suite. NSE received approval from the SEBI for these contracts. The derivatives have three serial monthly index futures and index options contract cycles, expiring on the last Friday of each month.

On the inaugural day (24th April), the derivatives received a positive response from the market participants. Over 375 trading members nationwide engaged in index derivatives trading. Trading activity included 1,223 futures contracts valued at Rs.78.16 crores, alongside 1,724 options contracts with a premium turnover of Rs.1.55 crores. The Exchange has also granted a waiver on transaction fees for Nifty Next 50 Index derivatives until October 2024.

The exchange’s move follows the introduction of derivatives on other indices and commodities, providing investors with diversified investment opportunities. Derivatives, categorized into futures and options, are financial contracts deriving their value from an underlying asset or benchmark, offering flexibility and risk management options to investors.

In recent years, NSE has launched derivative contracts for indices like Nifty Midcap Select (MIDCPNifty) and Nifty Financial Services (FINNifty) in the equity segment. Additionally, it has introduced various products in the commodity derivatives segment.

Derivative Contract Specifications

Wrapping Up

The Nifty Next 50 index is a dynamic representation of large-cap stocks ranking from 51st to 100th based on market capitalization on the stock exchange. Historically, it has delivered superior returns compared to both the Nifty 50 and Sensex. The index consists of stocks poised to emerge as market leaders in their sectors, presenting a promising long-term investment opportunity for investors. Eventually, the introduction of derivatives in the Junior Index is expected to expand its opportunities.